2022 tax return calculator canada

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. You can also create your new 2022 W-4 at the end of the tool on the tax return result page Start the TAXstimator Then select your IRS Tax Return Filing Status.

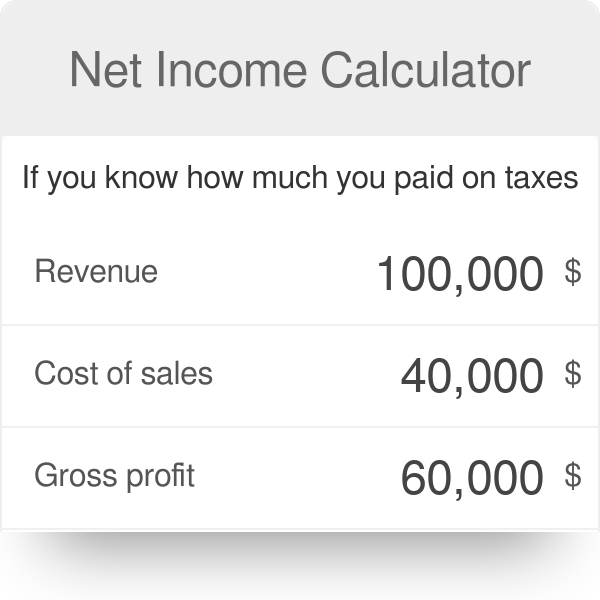

Net Income Calculator Find Out Your Company S Net Income

Tax Bracket Federal Tax Rate Federal Less than 4660500 15 4660500 - 9330800 205 9330800 - 14448900 26 14448900 - 20584200 29 More than 20584200 33 File your taxes the way you want.

. Choose The Best Service For You. Then select your IRS Tax Return Filing Status. Try Now for Free.

40000 x 15 20000 x 15 6000 3000. Tax Calculator Refund Estimator for 2022 IRS Tax Returns Estimated Results 0000. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify.

We strive for accuracy but cannot guarantee it. Canadian corporate tax rates for active business income. Estimate your refund with TaxCaster the free tax calculator that stays up to date on the latest tax laws.

File with an Expert File in an office. Ad Compare Wide Range Of Tax Return Calculator. Amounts earned up to 46226 are taxed at 505.

See how The New Equation can solve for you. Tax calculator 2022 Follow PwC Canada We are a community of solvers combining human ingenuity experience and technology innovation to deliver sustained outcomes and build trust. Taxable Income Calculate These calculations do not include non-refundable tax credits other than the basic personal tax credit.

Audit Defence and fee-based support services are excluded. Personal tax calculator. Ad 100s of Top Rated Local Professionals Waiting to Help You Today.

We receive it on or before May 2 2022 it is postmarked on or before May 2 2022. Select Status Employment Status Employee Self-Employed Tax Year 2020 2021 3. You can receive credits for many other expenses such as medical expenses tuition donations.

Calculations are based on rates known as of June 17 2022 including federal and provincialterritorial tax changes known at this time. Calculate your after tax salary for the 2022 tax season on CareerBeacon. Upload Edit Sign PDF Documents Online.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. 2021 2022 tax brackets and most tax credits have been verified to. You can also explore Canadian federal tax brackets provincial tax brackets and Canadas federal and.

The best starting point is to use the Canadian tax refund calculator below. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax Tables. Of course if you are ready to prepare and eFile your 2022 Return then lets go and e-file your taxes now.

Offer valid for returns filed 512020 - 5312020. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Here is a list of credits based on the province you live in.

Use our free 2022 Canada income tax calculator to see how much you will pay in taxes. Earnings 150000 up to 220000 the rates are 1216. 2022 - Includes all rate changes announced up to June 1 2022.

July 22 2022 WOWA Trusted and Transparent Estimate your income taxes by providing a few details about yourself and your income. 2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory. The tax rates for Ontario in 2022 are as follows.

2022 RRSP savings calculator. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. This guarantee cannot be combined with the TurboTax Satisfaction Easy Guarantee.

This Pages Content Was Last Updated. Special Latest Deals On Premium Services. Assumes RRSP contribution amount is fully deductible.

Ad Easily Automate Manage Optimize Document Workflow. The tax-filing deadline for most individuals is April 30 2022 Since April 30 2022 falls on a Saturday your return will be considered filed on time in either of the following situations. Select Province BC AB SK MB ON QC NB NS PE NL 2.

You simply put in your details get your refund estimation and then decide if you want to apply. Click on the annual salary amount to see the tax return example with pre-calculated tax return amounts or click on the individual province name to enter your own amounts the Province Tax Calculator will then calculate your 20222023 tax return for you. For example if your non-refundable credits total 20000 and your taxable income is 40000 you are in the first tax bracket.

That means that your net pay will be 40568 per year or 3381 per month. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available. The government has proposed to deliver CAI payments on a quarterly basis starting this year.

The Canadian tax calculator is free to use and there is absolutely no obligation. Canadian Tax Brackets Your taxable income puts you in the following brackets. World-Class Tax Return Calculator.

All of the Taxpert Tax Calculators will give you answers to your personal questions without having to read all the latest Tax Mumbo Jumbo. This handy tool allows you to instantly find out how much Canadian tax back you are owed. Payments will start in July 2022 with a double-up payment that will return proceeds from the first two quarters of the 2022-23 fuel charge year April-June and July-September followed by single quarterly payments in October 2022 and January 2023.

Use our free 2022 Canada income tax calculator to see how much you will pay in taxes. Calculate your combined federal and provincial tax bill in each province and territory. Use our free tool to explore federal and provincial tax brackets and rates.

No cash value and void if transferred or where prohibited. Reflects known rates as of June 1 2022. The Canada Annual Tax Calculator is updated for the 202223 tax year.

You can also explore Canadian federal tax brackets provincial tax brackets and Canadas federal and provincial tax rates. Your average tax rate is 220 and your marginal tax rate is 353. Amounts above 46226 up to 92454 are taxed at 915.

The calculator reflects known rates as of June 1 2022. 8 rows Claims must be submitted within sixty 60 days of your TurboTax filing date no later than May 31 2022 TurboTax Home Business and TurboTax 20 Returns no later than July 15 2022. Your Results Yearly Monthly Biweekly Weekly Daily Hourly Total Income 000 Total Tax 000 Net Pay 000 Marginal Tax Rate 158.

For amounts 92454 up to 150000 the rate is 1116. 0 Estimates change as we learn more about you Income 000 - Deductions 1255000 Tax Bracket 10 Effective Tax Rate 0 Basic For Simple tax returns only Start for Free Pay only when you file we recommend. It all adds up to The New Equation.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Receive Fast Free Tax Preparation Quotes From The Best Tax Accountants Near You. Calculate the tax savings your RRSP contribution generates in each province and territory.

Calculate the tax savings your RRSP contribution generates.

What Is Cryptocurrency How To Calculate Cryptocurrency Canadian Tax In 2022 Cryptocurrency Investing In Cryptocurrency Bitcoin

Pin By Maths Made Easy On Mock Papers By Mme Sumome Landline Phone Paper

Tax Returns Preparation Services

Fbr Called For Income Tax Proposals For 2021 2022 Budget

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

What Is A Good Rate Of Return On Investments Reverse The Crush In 2022 Investing Investing Money Income Investing

Cryptocurrency Taxation In Canada In 2022 Cryptocurrency Capital Assets Goods And Services

Know Your Worth Then Add Tax Taxreliefcenter Inspiration Preparing For Retirement Best Money Saving Tips Tax Prep

Rental Property Owner Management Kit Rental Owner Printable Business Manager Landlord Tool Rental

The Ultimate 5 Property Rental Real Estate Template Excel Template For Landlords Rental Property Template

How To Register And Open A Cra My Account In 2022 Personal Finance Lessons Energy Saving Tips Accounting

Simple Tax Calculator For 2021 Cloudtax

Rental Property Management Fee Tracker

Forget Everything You Ve Heard About What Is A Good Cap Rate Investment Property In 2022 Real Estate Investing Real Estate Investing Rental Property Real Estate Tips

Excel Formula Income Tax Bracket Calculation Exceljet